IPO or Initial Public Offer is a way for a company to raise money from investors for its future projects and get listed to Stock Exchange. It is the selling of securities to the public in the primary stock market. An Initial Public Offering (IPO) referred to simply as an “offering” or “flotation,” is when a company (called the issuer) issues common stock or shares to the public for the first time. They are often issued by smaller, younger companies seeking capital to expand, but can also be done by large privately-owned companies looking to become publicly traded.

Company raising money through IPO is also called as company ‘going public’. Initial Public Offerings (IPOs) represent the transition point of companies from a private status to a publicly held status. Thus, IPOs represent one of the most closely observed events in the stock market since they mark the inception of a new trading opportunity. Since every business starts as a small enterprise, the new player on the stock market issues only a few stocks, which results in a relatively small number of stockholders.

In an IPO the issuer may obtain the assistance of an underwriting firm, which helps it determine what type of security to issue (common or preferred), best offering price and time to bring it to market. From an investor point of view, IPO gives a chance to buy shares of a company, directly from the company at the price of their choice (In book build IPO’s). Many a times there is a big difference between the price at which companies decides for its shares and the price on which investor are willing to buy share and that gives a good listing gain for shares allocated to the investor in IPO. An IPO can be a risky investment. For the individual investor it is tough to predict what the stock or shares will do on its initial day of trading and in the near future since there is often little historical data with which to analyze the company. Also, most IPOs are of companies going through a transitory growth period, and they are therefore subject to additional uncertainty regarding their future value. From a company prospective, IPO help them to identify their real value which is decided by millions of investor once their shares are listed in stock exchanges.

When a company lists its shares on a public exchange, it will almost invariably look to issue additional new shares in order at the same time. The money paid by investors for the newly-issued shares goes directly to the company. An IPO, therefore, allows a company to tap a wide pool of stock market investors to provide it with large volumes of capital for future growth. The company is never required to repay the capital, but instead the new shareholders have a right to future profits distributed by the company and the right to a capital distribution in case of a dissolution.

The existing shareholders will see their shareholdings diluted as a proportion of the company’s shares. However, their capital investment will make their shareholdings more valuable in absolute terms. In addition, once a company is listed, it will be able to issue further shares via a rights issue, thereby again providing itself with capital for expansion without incurring any debt. This regular ability to raise large amounts of capital from the general market, rather than having to seek and negotiate with individual investors, is a key incentive for many companies seeking to list.

Bolster and diversify equity base

Enable cheaper access to capital

If there were no uncertainties, there would be no need for insurance.

Exposure and prestige

Attract and retain the best management and employees

Facilitate acquisitions

Create multiple financing opportunities

The first step a company should take in order to become publicly traded includes registration with the Securities and Exchange Commission (the SEC). After this a public offering is prepared, which should include a company’s prospectus and other legal documents that are required by the SEC.

Every potential investor has the right to receive a company’s prospectus. The latter represents a legal and accounting document, which explains in detail the situation in the company, including information about the senior staff, majority stockowners and the potential risks the company faces.

“Draft Offer document” is prepared by Issuer Company and the Book Building Lead Manager of the public issue. This document is submitted to SEBI for review. After reviewing this document either SEBI ask lead managers to make changes to it or approve it to go ahead with IPO processing. It is usually a PDF file having information of an investor who needs to know about the public issue. It mainly contain information about the company, its business, management, risk involve in applying to this issue, company financials and the reason why company is raising money through IPO.

Once the ‘Draft Offer document’ cleared by SEBI, it becomes “Offer Document”. Offer Document is the modified version of ‘Draft Offer document’ with SEBI suggestions. “Offer Document” is submitted to the registrar of the issue and stock exchanges where Issuer Company is willing to list.

Once “Offer Document” gets clearance from Stock Exchanges, Issuer Company add Issue size and price of the issue to the document and make it available to the public. The issue prospectus is now called “Red Herring Prospectus”.

A company that is planning an IPO appoints lead managers to help it decide on an appropriate price at which the shares should be issued. There are two ways in which the price of an IPO can be determined: either the company, with the help of its lead managers, fixes a price or the price is arrived at through the process of book building.

Book Building is basically a process used in IPOs for efficient price discovery.It is a mechanism where,during the period for which the IPO is open, bids are collected from investors at various prices, which are above or equal to the floor price. The offer price is determined after the bid closing date.

Once ‘Draft Prospectus’ of an IPO is cleared by SEBI and approved by Stock Exchanges then it’s up to company going public to finalize the date and duration of an IPO. Company consult with the Lead Managers, Registrar of the issue and Stock Exchanges before decides the date.

Below is the detail process flow of a 100% Book Building Initial Public Offer IPO. This process flow is just for easy understanding for retail IPO investors. The steps provided below are most general steps involve in the life cycle of an IPO

Prepare draft offer prospectus document for IPO

File draft offer prospectus with SEBI

Road shows for the IPO

Submit the Offer Prospectus to Stock Exchanges, registrar of the issue and get it approved

Decide the issue date & issue price band with the help of Issuer Company

Modify Offer Prospectus with date and price band. Document is now called Red Herring Prospectus

Red Herring Prospectus & IPO Application Forms are printed and posted to syndicate members; through which they are distributed to investors

Once all allocated shares are transferred in investors dp accounts, Lead Manager with the help of Stock Exchange decides Issue Listing Date

Finally share of the issuer company gets listed in Stock Market.

Initial Public Offering can be made through the fixed price method, book building method or a combination of both.

Difference between shares offered through book building and offer of shares through normal public issue (Source: BSE):

| Features | Fixed price process | Book building process |

| Pricing | Price at which the securities are offered/allotted is known in advance to the investor. | Price at which securities will be offered/allotted is not known in advance to the investor. Only an indicative price range is known. |

| Demand | Demand for the securities offered is known only after the closure of the issue. | Demand for the securities offered can be known everyday as the book is built. |

| Payment | Payment if made at the time of subscription wherein refund is given after allocation. | Payment only after allocation |

Company coming up with Book Building Public Issue decide a price band for the issue. The price band usually contains an upper level and a lower level. Floor Price is the minimum price (lower level) at which bids can be made for an IPO. Investors can bid for the Book Build IPO at any price in the price band decided by the company. In Book Build process retail investors have an addition option to choose “Cut-Off” price for bidding. Cut-off price means the investor is ready to pay whatever price is decided by the company at the end of the book building process. Retail investor has to pay the highest price while placing the bid at Cut-Off price.

Registrar of a public issue is a prime body in processing IPO’s. They are independent financial institution registered with SEBI and stock exchanges. They are appointed by the company going public. Responsibility of a registrar for an IPO is mainly involves processing of IPO applications, allocate shares to applicants based on SEBI guidelines, process refunds through ECS or cheque and transfer allocated shares to investors Demat accounts.

Investors can apply for shares in an IPO in 4 different categories-

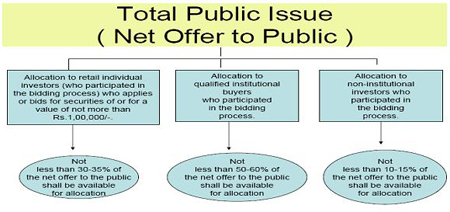

n retail individual investor category, investors can not apply for more then Rs one lakh (Rs 1,00,000) in an IPO. Retail Individual investors have an allocation of 35% of shares of the total issue size in Book Build IPO’s. NRI’s who apply with less then Rs 1,00,000 /- are also considered as RII category.

If retail investor applies more then Rs 1,00,000 /- of shares in an IPO, they are considered as HNI.

Individual investors, NRI’s, companies, trusts etc who bid for more then Rs 1 lakhs are known as Non-institutional bidders. They need not to register with SEBI like RII’s. Non-institutional bidders have an allocation of 15% of shares of the total issue size in Book Build IPO’s.

Financial Institutions, Banks, FII’s and Mutual Funds who are registered with SEBI are called QIB’s. They usually apply in very high quantities. QIBs are mostly representatives of small investors who invest through mutual funds, ULIP schemes of insurance companies and pension schemes. QIB’s have an allocation of 50% of shares of the total issue size in Book Build IPO’s.

The issue size has to be big, the bigger the issue, the higher is the capability of the promoters

Money begets more money, so if they have raised more money, be sure, they will be able to earn more

A higher promoters stake is a must, instills a sense of responsibility

A background check on the promoters capabilities

Size of projects in the pipeline, will indicate the scalability of the company

Last but not the least, in big companies, look for long term wealth creation and not speculative gains

To know about our offerings - Demat, Shares, Mutual Funds, IPOs, Insurance, Commodities and more…

Ensure the security of your investments by updating your nominee details in your trading & demat account online. It’s quick and hassle-free!

📌 Act Now to Stay Compliant

For assistance, contact our Customer Care at 0562‑4266666 and email askus@rmoneyindia.com.

IT'S TIME TO HAVE SOME FUN!

Your family deserves this time more than we do.

Share happiness with your family today & come back soon. We will be right here.

Investment to ek bahana hai,

humein to khushiyon ko badhana hai.

E-mail

askus@rmoneyindia.com

Customer Care

+91-9568654321