Mutual fund is a managed group of owned securities of several corporations. It is a body corporate that pools the savings of a number of investors and invests the same in a variety of different financial instruments. Using a mutual fund is one way to invest in the stock or bond market without buying individual stocks or bonds. Income earned through these investments and the capital appreciations realized are shared by its unit holders. They are operated by an investment company which raises money from the public and invests in a group of assets (shares, debentures etc.), in accordance with a stated set of objectives. It is a substitute for those who are unable to invest directly in equities or debt because of resource, time or knowledge constraints.

These corporations receive dividends on the shares that they hold and realize capital gains or losses on their securities traded. Investors purchase shares in the mutual fund as if it was an individual security. After paying operating costs, the earnings (dividends, capital gains or loses) of the mutual fund are distributed to the investors, in proportion to the amount of money invested. Investors hope that a loss on one holding will be made up by a gain on another. Mutual fund shares are able to collectively gain the advantage by diversifying their investments.

The units of mutual funds are also tradable securities. Mutual fund units are issued and redeemed by the Fund Management Company based on the fund’s net asset value (NAV) which is declared periodically by the issuer of the fund. NAV is calculated as the value of all the shares held by the fund, minus expenses, divided by the number of units issued. Buying and selling into funds is done on the basis of NAV-related prices. Mutual Funds are usually long term investment vehicle.

Each mutual fund will have a pre-defined objective, so you can choose a fund that is aggressive, conservative, a fund that invests only in stocks or only in bonds; or a fund that can invest in a multitude of things depending on what the fund’s management committee thinks would be bes

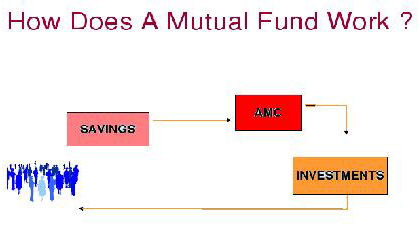

Mutual funds are financial intermediaries

They collect savings from a large no. of small investors

They then invest these funds in a diversified portfolio

The investment in a diversified portfolio allows the minimisation of risk

Thus they minimize risk and maximise returns for their participants

The modern mutual fund was first introduced in Belgium in 1822. This form of investment soon spread to Great Britain and France. Mutual funds became popular in the United States in the 1920s and continue to be popular since the 1930s, especially open-end mutual funds. Mutual funds experienced a period of tremendous growth after World War II, especially in the 1980s and 1990s.

Mutual fund (MF) houses have to maintain meticulous records of every transaction made by each of their investors. Registrar and Transfer agents (R&T agents) help them do this

Every mutual fund house has a large number of investors and it is essential to maintain records of all transactions made by each investor. Registrar and Transfer agent (R&T agent) is a body that maintains these records on behalf of the fund house. There are two main R&T agents in India—Computer Age Management Services (Cams) and Karvy. Few MFs, such as Franklin Templeton MF, have their own in-house R&T agents.

An R&T agent acts as a third-party on behalf of a fund house and has a vital role to play. It has a wide network through which it helps investors with their transactions, for example, getting the forms of various fund houses, transacting with fund houses or providing account statements. An R&T agent also provides technology-based services like online transaction or account statement facilities. It acts as single-window system for investors.

An R&T agent also helps investors with information on various corporate actions like details on new fund offers, dividend distributions or even maturity dates of investments. This information is also available with the fund houses, but an R&T Agent is a one-stop shop for all the information. Investors can get information about his various investments into different schemes of different fund house at a single place.

An R&T agent helps MF investors in submitting forms. This is very useful, especially for those investors who want to invest in many MFs. As per the Securities and Exchange Board of India’s (Sebi) rules, there is a cut-off time by when the investment has to be made for that day. So, if an investor has to make multiple investments, he can use an R&T agent’s single window system instead of rushing to different fund houses to submit applications.

R & T agents also help MFs reduce costs. Since they are present across the country, they also double as branches for their affiliated MFs as point-of-sale terminals.

SEBI has recently allowed registered stockbrokers to transact mutual fund units on behalf of their clients through the stock exchange mechanism. The market regulator has now allowed mutual funds to be traded on stock exchanges so that more investors can access them and have a basket of various categories of securities to get assured of maximum returns. When the systems are in place there are a few points the investor has to consider while investing in mutual funds through Stock Exchanges (NSE and BSE)

Existing mutual fund investors who intend to buy more units will also benefit as this system will allow them to keep track of all investments under a single statement

Investors can hold units of mutual fund schemes in dematerialised form. Buying and selling will become more efficient and transparent , particularly if investors choose to transact through a demat account

Though cost seems to be a factor for those who do not have a demat account, the impact will be minimal for those who already are demat account holders

End users can use the convenience of their neighboring broker’s office for their mutual fund transactions

In reduces the clutter of paperwork and speedy execution

The prospectus is a legal document that includes information about the mutual fund, terms of the offer, the issuer, and its objectives. The information in the prospectus is usually lengthy, packed with tables and graphs, and written in technical and legal language. This document is provided to help you make an informed investment decision before you invest in a mutual fund.

Following key sections have to be taken into consideration before investing in a Mutual fund:

A short statement of the fund’s investment objectives. Some funds intend to achieve short-term growth while others might focus on long-term stability.

Exactly how the fund plans to accomplish the objectives. This section describes the types of assets that the fund purchases.

Although mutual funds aim to make money for their investors, their ultimate goal, just like any other business, is to make money for themselves. In order to do so, funds charge their shareholders a variety of fees and expenses, all of which must be documented in the prospectus. A table at the front of every prospectus contains a breakdown of the different fees and expenses, along with a hypothetical projection of how the fees would impact a $10,000 investment over a 10-year period. This enables you to compare fees and expenses across mutual funds.

The level of risk that the fund takes and the risks that are associated with the specific investments made by the fund are one of the most important sections in the prospectus.

Information about the fund’s performance over the last 10 years is included. Investors should be aware that past performance is not necessarily an indicator of future results. As important is how well the fund has traditionally performed compared to an index, such as the S&P 500. A fund’s performance is also related to the fund’s volatility, dividend payments, and turnover.

The names the managers and some additional information about their experience and qualifications is reported. It can be helpful to know whether or not they have managed other funds in the past and their success or failure in order to get a sense of their past strategies and results.

Mutual funds split their prospectuses into two parts — the “prospectus” (described above) and the Statement of Additional Information (SAI). In 1983, the Securities and Exchange Commission required mutual funds to supply much more detailed information about the fund. These are included in the SAI. For legal purposes it is assumed that you have read it. If you don’t receive the SAI with the prospectus, you should request one. It provides great detail about the fund’s board of directors, any limitations on the fund’s investments, and the fees and expenses that are mentioned in the prospectus.

Mutual funds use professional managers to make the decisions regarding which companies’ securities should be bought and sold. The managers of the mutual fund decide how the pooled funds will be invested. Investment opportunities are abundant and complex. Fund managers are expected to know what is available, the risks and gains possible, the cost of acquiring and selling the investments, and the laws and regulations in the industry. The ability of the managers to select profitable investments and to sell those likely to decline in value is a key factor for the mutual fund to earn money for the investors.

Every year mutual funds send each investor an Annual Report. The Annual Report includes a list of the fund’s financial statements, a list of the fund’s securities, and explanations from the fund’s management as to why the fund performed as it did for the previous year.

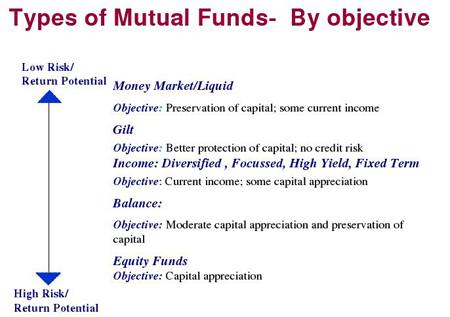

Funds that invest in equity stocks from firms with higher low Price to Earning (P/E) Ratio which usually pay small dividends are called equity funds. The investor is looking for capital gains rather than income. They carry the principal objective of capital appreciation of the investment over the medium to long-term. In growth funds, the dividend accrued, if any, is reinvested in the fund for the capital appreciation of investments made by the investor.

These funds invest in companies spread across sectors. These funds are generally meant for risk-averse investors who want a diversified portfolio across sectors.

These funds invest primarily in equity shares of companies in a particular business sector or industry. They are targeted at investors who are bullish or fancy the prospects of a particular sector.

The money collected from the investors is invested only in the stocks,which represent the indices like S&P CNX Nifty or CNX Midcap 200.The objective of such funds is to give a return equivalent to the market returns.

These funds offer tax benefits to investors under the Income Tax Act. They aim to minimize tax bills, such as keeping turnover levels low or shying away from companies that provide dividends, which are regular payouts in cash or stock that are taxable in the year that they are received. These funds still shoot for solid returns; they just want less of them showing up on the tax returns.

These funds invest predominantly in high-rated fixed-income-bearing instruments. The investor is looking for income which usually come from dividends or interest. These stocks are from firms which pay relative high dividends. This fund may include bonds which pay high dividends. They are best suited for the medium to long-term investors who are averse to risk and seek capital preservation. They provide a regular income to the investor.

These funds invest exclusively in certain kinds of highly liquid short-term instruments like money market. Investment period could be as short as a day. They provide easy liquidity.

These funds invest in Central and State Government securities. Since they are Government backed bonds they give a secured return and also ensure safety of the principal amount. They are best suited for the medium to long-term investors who are averse to risk.

The investor may wish to balance his risk between various sectors such as asset size, income or growth. A balanced fund invests equally in fixed income and equity in order to earn a minimum return to the investors. They provide a steady return and reduce the volatility of the fund. They are ideal for medium to long-term investors who are willing to take moderate risks.

Investors are allowed to enter and exit the fund even after the fund has closed. These funds do not have a fixed date of redemption. Generally they are open for subscription and redemption throughout the year. Their prices are linked to the daily net asset value (NAV).

These funds are open initially for entry during the Initial Public Offering (IPO) and thereafter closed for entry as well as exit. Once the fund closes investment can be withdrawn only at the end of the time period of the MF. These funds have a fixed date of redemption. One of the characteristics of the close-ended schemes is that they are generally traded at a discount to NAV; but the discount narrows as maturity nears. The units of these funds are listed on stock exchanges, are tradable.

Invest on-line in all mutual funds without the hassles of filling application forms or any signatures or proof of identity for investing.

Portfolio Diversification : Mutual funds help to reap the benefit of returns by a portfolio spread across a wide spectrum of companies

Professional management and research to select quality securities

Spreading Risk: Mutual fund will spread its risk by investing a number of sound stocks or bonds. A fund normally invests in companies across a wide range of industries, so the risk is diversified.

Transparency: Provides complete portfolio disclosure of the investments made by various schemes and also the proportion invested in each asset type.

Choice: Offer the investor a wide variety of schemes to choose from. An investor can pick up a scheme depending upon his risk/ return profile.

Regulations: Registered with SEBI and function within the provisions of strict regulation designed to protect the interests of the investor

No manual processes involved. Bank funds are automatically debited or credited while simultaneously crediting or debiting the unit holdings.

Control over your investments with online order confirmations and order status tracking.

Online updation of MF portfolio with current NAV to check the performance of investments

Purchase / Redemption: Purchase simply means buying mutual fund scheme units

Switch: To suit your changing needs ,transfer of cash between different schemes is possible. You can switch your cash online from one scheme to another in the same fund family without any hassles.

Systematic Investment plans (SIP): SIP allows to invest a certain sum of money over a period of time periodically by just filling in the investment amount, the period of investment, the frequency of investing.

Rupee Cost Averaging Adv.

Small Amount of Investment.

Disciplined Investing.

In order to cover their expenses mutual funds charge fees to the investors. Although these fees are only a few percentage points a year and seem like a minor expense, they create a serious drain on the performance over a period of years.

A mutual fund may charge fees when the investor sells shares back to the mutual fund.

A mutual fund may charge sales charges that are reduced at certain time intervals. For example, the fund may charge 6% of the sale price the first year after the shares are bought. Each year thereafter the fee would be reduced by 1% until no fee would be charged. This is an incentive for investors to leave their money in the fund.

Mutual funds may charge fees to cover expenses such as advertising, brokers’ costs and toll-free telephone lines. These are 12b-1 fees, regulated by law.

A fee is charged each time the investor transfers money within the company.

After paying operating costs, the earnings and losses of the mutual fund are distributed to the investors in proportion to the amount of money invested. An investor may chose to receive dividends as cash, or he can reinvest them into the fund. Many funds will automatically reinvest dividends with the investor authorization.

The mutual fund manager must send the investor a tax information statement so the investor can declare taxes. The investor must account for all capital gains or loses and dividends even if the dividends and capital gains are reinvested into the mutual fund. When mutual funds shares are sold/redeemed the mutual fund manager should aid the investor in determining the purchase bases for the shares sold/redeemed.

Don’t go by the past performance alone

Don’t go by blindly by hearsay about the reputations of a fund. There are various rating agencies which index the mutual funds regularly based on multiple factors

Don’t invest huge sums of money in a single fund or all the money in one go. Spread out your investments rationally.

Don’t chase a mutual fund because it is performing great in a bull run in the stock market. Once the market stagnates or the trend reverses these funds might crash.

Don’t compare a mutual fund across the category. While choosing a best one compare funds from the same category regardless of the promoting companies.

To know about our offerings - Demat, Shares, Mutual Funds, IPOs, Insurance, Commodities and more…

Ensure the security of your investments by updating your nominee details in your trading & demat account online. It’s quick and hassle-free!

📌 Act Now to Stay Compliant

For assistance, contact our Customer Care at 0562‑4266666 and email askus@rmoneyindia.com.

IT'S TIME TO HAVE SOME FUN!

Your family deserves this time more than we do.

Share happiness with your family today & come back soon. We will be right here.

Investment to ek bahana hai,

humein to khushiyon ko badhana hai.

E-mail

askus@rmoneyindia.com

Customer Care

+91-9568654321