Published : September 26, 2017

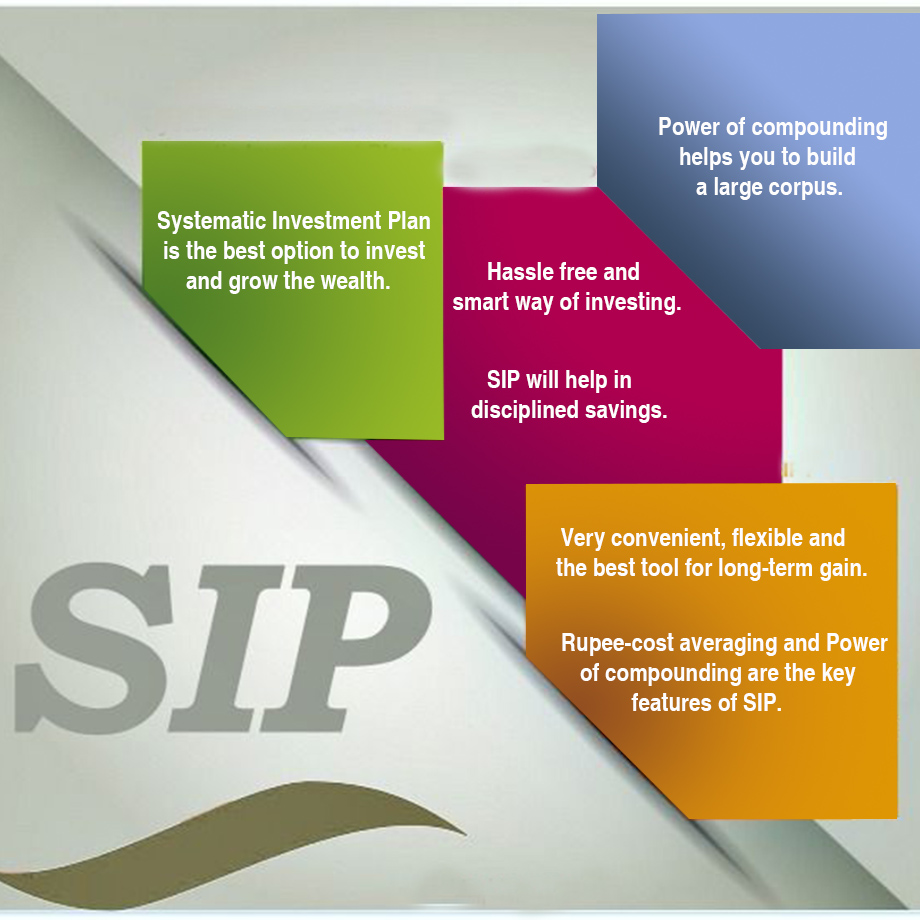

SIP, the systematic investment plan is for every one of us. Many of us have surplus money but remain confused on where to invest. Invest so that to get good returns. Now a day’s bank and post office fixed deposit (FD) and recurring deposit (RD) have become unattractive. Stock market gives a high return but it’s not everyone’s cup of tea. This is because of the high risk involved in the market. So, Systematic Investment Plan is the best option to invest and grow your wealth. Now let us understand what is systematic investment plan is and how can you systematically plan your investment.

As we discussed in the beginning, SIP refers to a systematic investment plan. A plan for investing systematically over a period of time is what SIP means. You can be systematic either by investing a fixed amount at a regular fixed interval. Or by investing some amount but at a fixed frequency of time. The regular or fixed frequency of time is crucial in SIP investments. You can do SIP in an instrument of your choice either for short-term or for a long-term. It all depends on your financial goal. You can also increase or decrease the amount you wish to invest. This you may do depending on the market situation affecting the instrument you choose.

In a way investing through SIP is somewhat similar to RD investments. In RD investments we deposit a fixed sum of money on a fixed day into our recurring deposit account. This account we may open with any bank or with the post office. In a similar way, we can deposit a fixed amount in any other investment instrument of our choice. Now, why do we need to systematize our investments? In next section, I exclusively discuss this.

The systematic investment plan is a hassle-free technique and smart way of investing money in instruments whose value fluctuates. It helps us make a disciplined approach towards investing. And infuses regular saving habits in us. SIP is convenient and a flexible technique best to make a long-term gain on our investments. This helps us to build our wealth for a lifetime period.

Did you remember your childhood days? Probably we all learned the benefit of SIP during our childhood days itself. You maintain a piggy bank and put coins or currency notes regularly that parents use to give. And at the end of the particular period, your every saved penny became a large amount. This is what SIP does to your money. SIP to operate on the simple principle of investing systematically and allow you to build wealth over the long-term.

In general, any SIP investments benefit from the long-term advantages of dollar-cost averaging (DCA). DCA is a technique in which you buy a fixed amount of a particular investment instrument on a regular schedule. This is regardless of the unit price of the instrument. You purchase more units when prices are low and fewer units when prices are high. In this way, your average cost per unit of the instrument decreases over time. This also makes us save regularly.

In SIP, you keep aside a fixed amount of money from your accounts. This you do at regular interval for a specified period of time. From this amount, you use to purchase some financial asset. You get an exact number of units of such asset according to the prevailing asset value. This strategy frees you from speculating in volatile markets. You get more units when the price is low and fewer units when the price is high. And in this way, the average cost per unit stays low in the long run. This strategy of investment is also called dollar cost average.

Dollar cost averaging (DCA) or unit cost averaging or cost average effect is an investment strategy. This helps overcome the impact of volatility on buying financial assets. Basically, in this strategy, you decide on two parameters. Firstly the fixed amount of money to invest each time. And secondly, the time range over which you do all of your investments. One key element to maximize profits with SIP investments includes the following. Buy through a down-trending market, employing an estimated method to acquire extra as the price falls. Then, as the course changes to a higher priced market, use a scaled plan to sell. Using this strategy, you can profit from any of the financial assets whose value changes over a period of time.

The market is not same every day. It fluctuates every minute and at one moment goes up and the second moment goes down. The market reacts to different economic events. Sometimes positive sometimes negative. So the price of most of the financial assets also goes up and down.

In sip, you invest regularly or say you purchase the units regularly irrespective of the market movement. So, when prices are up you purchase fewer units. And when the market is down, prices are low you buy more units with the same amount. And this thing happens regularly till a very long period, say 10 to 15 years.

Let us understand this with an example. Suppose you had invested directly a lumpsum amount in the stock market. In such case, it is possible for you to stay invested in falling market. In such cases, you see the loss and you may immediately withdraw your money from the market. But in SIP you stay invested and kept investing regularly irrespective of the market movement. The attitude of staying invested and regular investment gives a boost to your wealth. And this is also the key to successful investors.

The power of compounding, the compound interest is the “eighth wonder of the world”. When you invest for a long period, you earn returns on your returns. In this way, your money starts compounding. This effect of the power of compounding helps you to build a large corpus. This also helps you achieve your long-term financial goals with regular SIP investments. Suppose you start a SIP of INR 1000 monthly in a scheme of a mutual fund. You systematically do it for a tenure of 20 years and expect a modest return of 15% annually. Your money would grow to approximately INR 15 lac. So, over the long-term, SIPcompound your wealth better and systematically.

The following benefits you can expect while investing through SIP –

Over the years SIP has evolved around what investors want. Besides plain vanilla SIP, there are various other feature-rich facilities that complement the regular form of investing needs. Explore the various available alternate form of SIP and decide which one fulfill your needs properly.

Step-up SIP and top-up SIP are same. This allows you to rise your SIP amount at periodically. This accommodates, particularly in goal planning. For example, say you have a windfall income or bonus and you want to invest. So, you can start initially with a little amount and slowly raise the amount. Consequently, as your income rises, so do your expenses. Hence, building your investment properly will guard you against hard days.

Many a time, people continue the same monthly SIP investment for long periods. Though they may have made large profits if they had topped up their SIP. But in absence of any such top-up, they lose additional income. Don’t forget, adding up to the SIP usually is an apparent move to build up wealth. Additionally, you also have an option to go for a fixed or variable top-up according to your changing needs. You can either set a fixed limit to your top-up or keep it changeable. And, you can even set a date to continue with the top-up facility. You can set the frequency to SIP to half-yearly or yearly and opt for a monthly SIP as well.

In case you face uncertain cash flows, you can opt for flex or flexible SIP. This enables you to adjust your installment as you want. For example, you get a bonus of INR 10000. So with Flex SIP, you can allow it straight into any one of the instruments in your portfolio. This variant of SIP gives you the flexibility to increase or decreases the amount at any time.

With Trigger SIP, you can set an index level date or an event for your SIP to trigger. This helps you to take advantage of any anticipated movement. For example, suppose any Government policy is due next week that may impact index positively. So you can set it as a trigger date for picking some good shares for your portfolio. However, this induces speculative habit so you should give it less preference. Always refer to a long-term view to achieving your set of financial goals.

While preparing a SIP mandate, you must fix the start and end date. This will decide your pre-decided term period say 1 year, 5 years, etc. And once the SIP matures, don’t forget to renew it. Never end up missing few installments. It will upset the saving discipline and affect returns in the long run. So, once you achieve your goal corpus, you can redeem as per your convenience.

You can always plan to pause SIP installments in place of stopping SIPs especially in a financial crisis like situation. This may impede your path to systematic wealth creation. This option helps you to avoid the process of re-starting SIP. So you get the relief you need for those few months under distress. You can always continue with earlier SIP when things go normal and that too without any loss.

Thus, planning your investment systematically over a period of time is very much helpful. The financial goals of future become attainable with SIP easily. It provides you a sense of safety with no additional financial burden at any point in your life. A small step towards systematically savings and channelizing those savings to productive financial tools make you feel financially safe. So if you have a big plan and it seems impossible at present, don’t worry. Set it as a long-term goal. Take a small step now. Start a SIP with a small amount for a fixed period. And before the maturity of the investment revisit your set long-term goal. If you can achieve success in your set goal with this amount then congratulations. Else continue with SIP for some more time with some more amount. So SIP is a good investment option for your long term goals.

Enjoy flexible trading limits at

lowest brokerage rates ?

Open Your Investments Account Now

0Account Opening Charges

Life Time Demat AMC

Brokerage

Ensure the security of your investments by updating your nominee details in your trading & demat account online. It’s quick and hassle-free!

📌 Act Now to Stay Compliant

For assistance, contact our Customer Care at 0562‑4266666 and email askus@rmoneyindia.com.

IT'S TIME TO HAVE SOME FUN!

Your family deserves this time more than we do.

Share happiness with your family today & come back soon. We will be right here.

Investment to ek bahana hai,

humein to khushiyon ko badhana hai.

E-mail

askus@rmoneyindia.com

Customer Care

+91-9568654321