Published : August 28, 2017

Generally it is seen that the Investors find Mutual Fund difficult to understand so they refrain to invest in it. In this Article Rmoney will explain you about the basics of Mutual Funds, how do they work and how best they can serve as an investment tool in simple and comprehensive language.

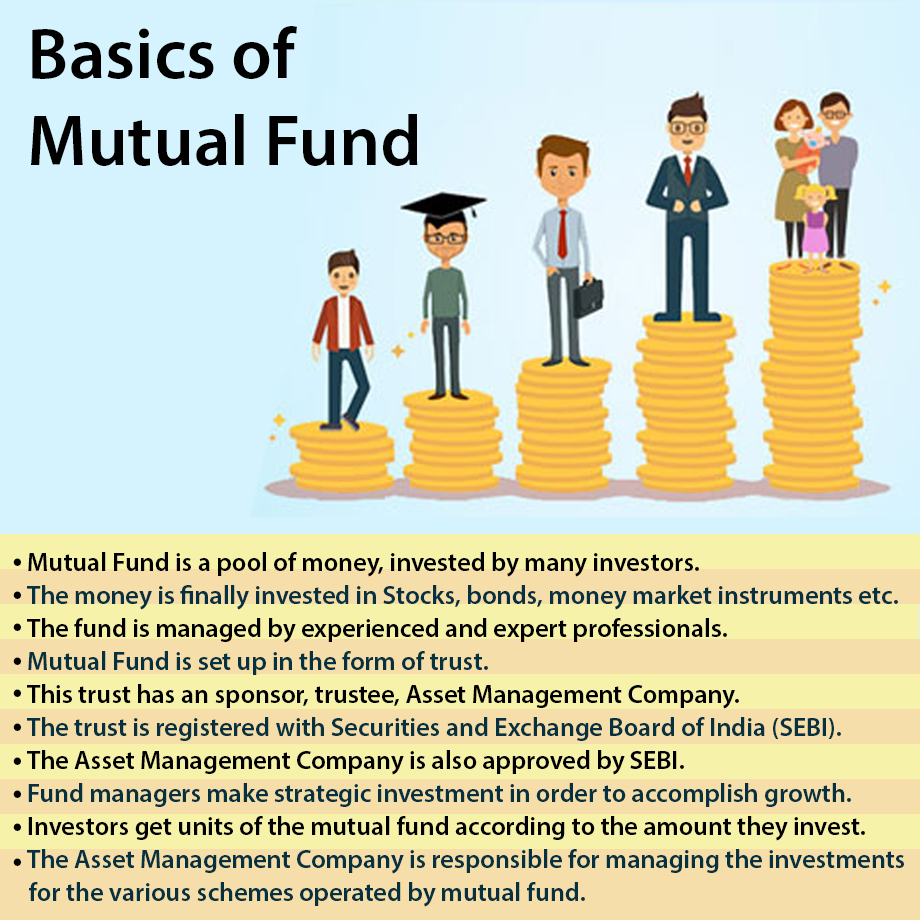

Mutual Fund is a trust that pools investor savings and trust invest this saving finally in Capital Market like Stocks, Bonds, short-term money market instruments and commodities such as precious metals.

This pool of money is managed by professionals, so it is also known as ‘Professionally managed investment fund’. It works like an investment vehicle because every investor can invest in the market through this pool of fund. It is a simple way to expand your investment.

Any investor who wants to make money from stock market but does not have enough knowledge about the market or don’t have time to track the portfolio and market timely they invest in this pool of money. A mutual fund is a growth industry, if you start early and systematically you can reap more benefit out of it.

A mutual fund is set up in the form of a trust which has a sponsor, Trustee, Asset Management Company (AMC). The trust is established by a sponsor, like a promoter of a company. And the trust is registered with Securities and Exchange Board of India (SEBI) as a Mutual Fund. The Asset Management Company is also approved by SEBI.

So, in this article, we have learnt about the basics of mutual fund like what is mutual fund and how does it operate and the main operating bodies of mutual fund.

Enjoy flexible trading limits at

lowest brokerage rates ?

Open Your Investments Account Now

0Account Opening Charges

Life Time Demat AMC

Brokerage

Ensure the security of your investments by updating your nominee details in your trading & demat account online. It’s quick and hassle-free!

📌 Act Now to Stay Compliant

For assistance, contact our Customer Care at 0562‑4266666 and email askus@rmoneyindia.com.

IT'S TIME TO HAVE SOME FUN!

Your family deserves this time more than we do.

Share happiness with your family today & come back soon. We will be right here.

Investment to ek bahana hai,

humein to khushiyon ko badhana hai.

E-mail

askus@rmoneyindia.com

Customer Care

+91-9568654321