Published : August 28, 2017

Derivatives are such financial Instruments that derive their value from their underlying security like Share, Commodity, Currency etc. Futures and Options are two types of derivatives.

A Future Contract is an agreement two parties to buy or sell an asset at a certain time at a future date at a certain price.

Such agreements are useful for those who do not have money to buy them now but can bring it to a certain date. These contracts are mostly used for Arbitrage by traders, which mean traders buy shares or commodity at the lower price in cash market and sell at a higher price in the Futures market. Here traders play with the price difference in two different markets.

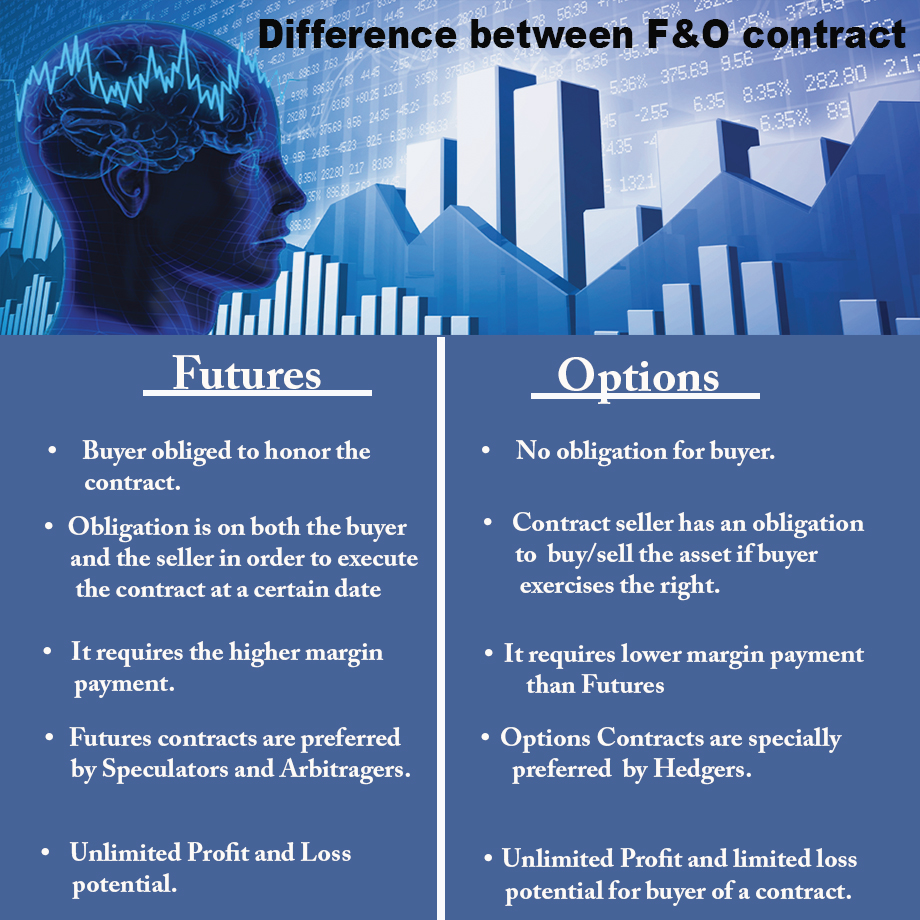

In case of Futures Contracts, the obligation is on both the buyer and the seller in order to execute the contract at a certain date.

An option gives the right to the buyer but not the obligation but the seller has an obligation to comply with the contract.

Whereas in case of futures contract the obligation is on the both part the buyer and the seller.

The call option gives the right to the buyer but not the obligation to buy a given quantity of the underlying asset at a certain price on or before the future date.

Puts give the buyer the right, but not the obligation to buy a given quantity of an underlying asset at a given price on or before a given future date.

In the option contract, if the buyer of the option chooses to exercise the option the seller is obliged to comply the contract. However, in case of the future contract, both counterparties are bound to settle the contract on or before date.

The major difference between the Future Contract and Options is: a buyer of an option pays the premium to buy the rights to exercise the option to the seller of the option. The seller of the option is also known as the writer of the option. This is the reason why the seller is obliged to sell/buy the asset if the buyer chooses to exercise the option.

Enjoy flexible trading limits at

lowest brokerage rates ?

Open Your Investments Account Now

0Account Opening Charges

Life Time Demat AMC

Brokerage

Ensure the security of your investments by updating your nominee details in your trading & demat account online. It’s quick and hassle-free!

For assistance, contact our Customer Care at 0562‑4266666 and email askus@rmoneyindia.com.

IT'S TIME TO HAVE SOME FUN!

Your family deserves this time more than we do.

Share happiness with your family today & come back soon. We will be right here.

Investment to ek bahana hai,

humein to khushiyon ko badhana hai.

E-mail

askus@rmoneyindia.com

Customer Care

+91-9568654321