Published : August 25, 2017

We can see Market Indices almost in every country. And people watch and track these indices almost every day. You may also know some of the Market Indices like NIFTY, SENSEX, NASDAQ etc. when we say market going up and down we talk about these stock market indices only.

In this article, Rmoney will provide the basic introduction of Market Indices. This will make you understand what these indices are and why they are important?

Many stocks are listed on the exchange. From among these listed stocks, some stocks are selected and grouped together to form an index. The classification is being done on the basis of the industry, size of the company, market Capitalization etc.

For example, BSE Sensex consists of 30 stocks. Similarly, NIFTY50 consists of 50 stocks.

The value of the grouped stocks is being calculated by the value of the index. If there is any change in the price of the stocks it leads to the change in the value of the Index as well. An index is an indicator of the movements in the market.

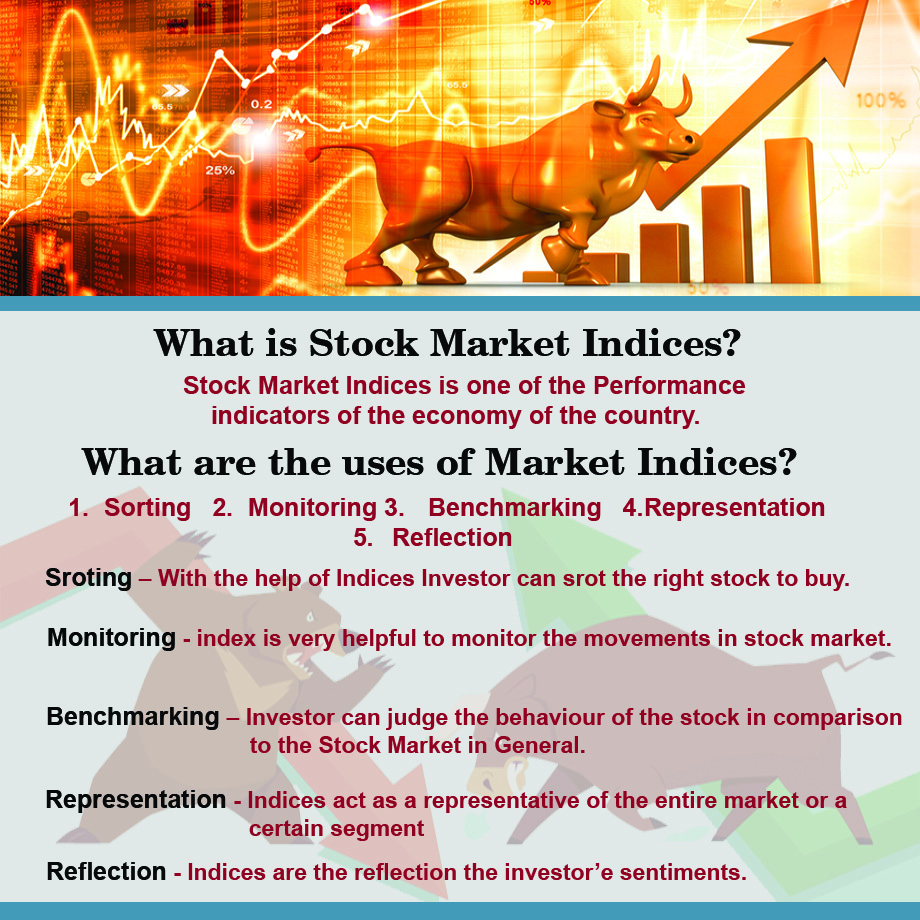

Indices are an important part of the stock market. It can be used for many purposes as follows:

1. Sorting:

There are hundreds of companies listed on the exchange and it is difficult to differentiate between all of them and choose the best one to invest. So to buy the stocks how will an investor sort them out? So in order to solve or deal such critical phase Indices are proved to very help full tool to sort the best stocks to invest.

Companies and their shares are classified into indices based on key features like size of the company, sector or industry they belong to.

2. Monitoring:

The major use of an index is to monitor the movements in the stock market. Because all the indexes use same base year and same value to derive the comparisons amongst them. Indices are the most favorable way to track the stock price movement worldwide.

3. Benchmarking:

Indices are indicators to the investors to tell them how a stock is behaving in comparison to the stock market in general. This is the easy way to benchmark the stock.

In order to track the performance of the stock in comparison to the other stocks, it is essential to know the growth of the stock and the growth of the relative index. We just compare the price trends of the index and the stock.

So, for an effective comparison Indices can also be used to compare the stocks. For example: on some day, the benchmark index BSE Sensex jumps 300 bps, but this hike may be limited to a certain set of Stocks like IT, telecom etc..

So at the time of fall or rise in the market, the Index can be used for comparison in spite of comparing the individual stocks.

This also helps investors to identify the market trends easily.

4. Representation:

Indices are the representative of the entire market or a certain segment. In the Indian stock market, the BSE Sensex and the NSE Nifty are considered as the benchmark indices.

Indices are considered to represent the performance of the market as a whole. For example, an index formed of telecom stocks is supposed to represent all stocks of the telecom industry.

5. Reflection:

Indices are the reflection the investor’s sentiments. Investor’s sentiments play very crucial role in stock market movements. It happens because, when sentiments are positive, there will be a rise in demand for a stock and this trend will lead to a rise in prices.

Indices help in reflecting the investor’s mood – this is not just limited to the market, even you can the impact on sector wise as well as on the company size.

6. Measurement of Riskiness:

At the time of determining the riskiness of the stock, indices play a crucial part. The value which is derived from the indices is a very important component to measure the risk.

In order to measure the riskiness, data is collected which compares the riskiness of the stock as well as indices. Then this data is converted into a statistical measure which is known as “Beta”, which is the universal measure of riskiness.

7. Derivatives:

Indices are also used as the basis to derive the derivative contracts. Derivative traders base their contracts on these indices.

Enjoy flexible trading limits at

lowest brokerage rates ?

Open Your Investments Account Now

0Account Opening Charges

Life Time Demat AMC

Brokerage

Ensure the security of your investments by updating your nominee details in your trading & demat account online. It’s quick and hassle-free!

📌 Act Now to Stay Compliant

For assistance, contact our Customer Care at 0562‑4266666 and email askus@rmoneyindia.com.

IT'S TIME TO HAVE SOME FUN!

Your family deserves this time more than we do.

Share happiness with your family today & come back soon. We will be right here.

Investment to ek bahana hai,

humein to khushiyon ko badhana hai.

E-mail

askus@rmoneyindia.com

Customer Care

+91-9568654321